- EFFECTIVE UTGST (RATES) NOTIFICATIONS

- IGST (Rates) Notification

- UTGST Circular

- UTGST (Rules) Notification

- SGST Circular

- Cess Circulars

- Compensation Cess (Rules) Notification

- Compensation Cess (Rates) Notification

- CGST (Rates) Notification (Effective)

- CGST (Rules) Notification (Effective)

- CGST (Rates) Notification

- IGST Circulars

- IGST (Rules) Notification

- CGST Circular

- CGST (Rules) Notification

NEWS UPDATES

NEWS UPDATES

- 3 Indian women from Gujarat died in mega SUV accident in US

- JNU switches to NET in place of entrance test for PhD admissions

- GST - fake invoice - Patanjali served Rs 27 Cr demand notice

- I-T - Bonafide claim of deduction by assessee which was accepted in first round of proceedings does not tantamount to furnishing of inaccurate particulars, simply because it was disallowed later: ITAT

- India-bound oil tanker struck by Houthi’s missiles in Red Sea

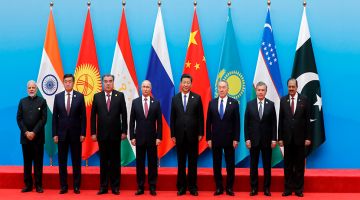

- SCO Defence Ministers' Meeting endorses 'One Earth, One Family, One Future'

- RBI issues draft rules on digital lending

- I-T - In order to invoke revisionary jurisdiction u/s 263, twin conditions of error in order and also prejudice to interest of Revenue must be established independently: ITAT

- CRPF senior official served notice of dismissal on charges of sexual harassment

- Indian Air Force ushers in Digital Transformation with DigiLocker Integration

- Columbia faculty blames leadership for police action against protesters

- CX - When process undertaken by assessee does not amount to manufacture, even then CENVAT credit is admissible if such inputs are cleared on payment of duty which would amount to reversal of credit availed: CESTAT

- Google to inject USD 3 bn investment in data centre in Indiana

- Cus - The equipments are teaching accessories which enable students in a class to respond to queries and these equipments are used along with ADP machine, same merits classification under CTH 8471 60 29: CESTAT

- UN says clearing Gaza mounds of rubble to take 14 yrs

- ST - When issue is of interpretation, appellant should not be fastened with demand for extended period, the demand confirmed for extended period is set aside: CESTAT

- Blinken says China trying to interfere US Presidential polls

- World Energy Congress 2024: IREDA CMD highlights need for Innovative Financing Solutions