- EFFECTIVE UTGST (RATES) NOTIFICATIONS

- IGST (Rates) Notification

- UTGST Circular

- UTGST (Rules) Notification

- SGST Circular

- Cess Circulars

- Compensation Cess (Rules) Notification

- Compensation Cess (Rates) Notification

- CGST (Rates) Notification (Effective)

- CGST (Rules) Notification (Effective)

- CGST (Rates) Notification

- IGST Circulars

- IGST (Rules) Notification

- CGST Circular

- CGST (Rules) Notification

|

Table of Contents

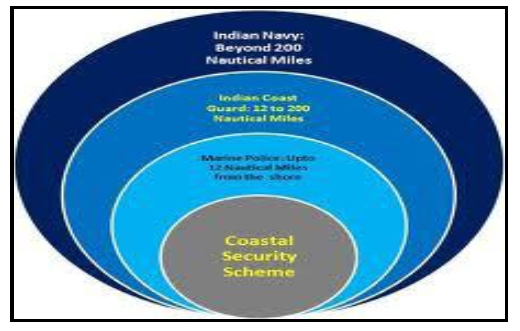

Chapter VIII Customs Capacity Building VIII.1 Introduction According to the definition adopted by the World Customs Organization (WCO), capacity building is commonly understood to mean developing or acquiring the skills, competencies, tools, processes and resources needed to improve the capacity of the administration to carry out its allotted functions and achieve its objectives. The rapidly changing global trading environment, marked by steadily growing volumes and complexity of supply chains, and heightened security perceptions have had a large impact on the role and functions of customs administrations everywhere. On the one hand, globalisation has been an engine of economic growth, enhancing the importance of the trade facilitation role of customs and other border agencies as key determinants of a country's economic competitiveness and attraction as an investment destination. On the other, it continues to offer new opportunities for criminal organisations to engage new types of fraud and pose multidimensional challenges to customs administrations. Customs administrations have had to respond to these challenges by redefining their roles, reorienting their strategies and altering the traditional control paradigm that had served them well in the older, more uncomplicated times. They have had to build newer technological, human and organisational capabilities and adopt governance practices congruent with modern standards to both effectively deal with risks as well as meet growing client expectations for higher service standards. In the process, the best practice customs administrations have radically transformed their structures and business processes, taking advantage of the opportunities the rapid advance of technology offers. While Indian customs too have moved forward in this direction, they still have a long road ahead, which cannot be traversed unless some key gaps in terms of capacity building are filled. This paper seeks to identify some of those key gaps and the measures needed to fill them. It needs to be mentioned at the outset that the TARC had, in its first report, given a large number of recommendations in the areas of governance, structures and processes, people management and information and communication technologies. These recommendations have a direct bearing on the topic of this report and have to be kept in mind while dealing with the issue of customs capacity building. VIII.2 Snap shot of customs in India The Central Board of Excise and Customs (CBEC) has several field formations to help it discharge its responsibilities of levying and collecting customs duties and preventing smuggling under the Customs Act, 1962. These include the 11 Customs/Customs (Preventive) zones and 35 commissionerates spread all over the country. In the ongoing cadre restructuring of the department, the number of Customs/Customs (P) commissionerates are proposed to be increased to 60. While customs commissionerates are primarily responsible for collection of customs duties and implementation of allied acts, vigil over coastal and land borders is maintained by preventive commissionerates to thwart any attempt at smuggling. However, the role of the preventive commissionerates is not limited to anti-smuggling operations only and almost all the preventive commissionerates are entrusted with the added responsibility of appraisement work in respect of goods imported/exported through smaller ports, airports, inland container depots and land customs stations, which fall within their geographical jurisdiction. The marine and telecommunications wings under the Directorate of Logistics also assist in keeping surveillance over the borders. Wherever there is no customs formation, the functions under the Customs Act are discharged by central excise officers. In some border areas, like the Indo-Pak border in the state of Jammu & Kashmir, other border enforcement agencies like the BSF are also notified under the Customs Act to discharge the functions of customs officers. These formations manage operations in nearly 100 ports (along with the associated CFSs), over 40 international airports and over 100 inland container depots. Besides, there are about 112 land customs stations, although only a few see significant cross-border trade. At the last count, there were 387 SEZs of which 192 were operational. Besides, the central excise field formations also administer a large number of 100 per cent export oriented units (EOUs). There are also a large number border check posts and coastal units which perform anti-smuggling functions. The organisation of the field formations is largely territorial and all key functions are located under one roof in each large customs office. The assessment work, however, is carried out in appraising groups that are organised along commodity groups, each dealing with specified groups of tariff headings; this organisation is uniform across customs locations. The officers are subject to regular rotation among jobs, which we have identified in our first report as a major factor that leads to lack of specialisation. The CBEC is assisted in specific customs related functions by four Directorates – the Directorate of Revenue Intelligence, the Directorate of Export Promotion, the Directorate of Safeguards, and the Directorate of Valuation and one division, called the Risk Management Division.

The growth in the volume as well as complexity of international trade has naturally led to an increase in the workload of customs. Data furnished by the CBEC shows that, from 1997 to 2014, the number of import documents processed by customs has gone up 7 times. There has been a twenty-fold increase in the value of imports from Rs.1540000 crore to Rs.30,00,000 crore. Customs revenue rose from Rs.41,000 crore in 1997-98 to Rs.1,75,000 crore in 2013-14. With the progressive reduction in peak rates of customs duties over the years, the percentage share of customs revenue in the total tax revenue of the central government has shown a declining trend, although in absolute terms, there has been a positive growth, mainly due to increase in the volume of international trade and imports. This is indicated in Table 8.1 below. Table 8.1: Total tax revenue of the central government and the share of customs duties

Customs also have the responsibility for the processing of import and export goods under a number of export incentive schemes, besides the disbursement of customs duty drawback on goods exported from the country. Table 8.2 gives the data on revenue foregone (tax expenditure) on various such schemes. Table 8.2: Revenue foregone

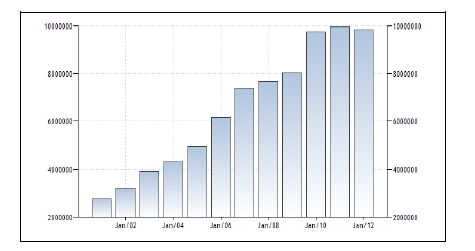

Source: http://www.tradingeconomics.com Graph 8.1 depicts the steady growth in the number of containers handled in Indian ports. There has been a steady growth in international passenger traffic. The number of passengers passing through international airports has grown from 19.42 million in 2004-05 to 46.62 million in 2013-14.104 The enforcement function to implement customs and allied laws on the borders is discharged by the Directorate General of Revenue Intelligence, Customs (Prev.) Commissionerates and the Special Intelligence and Investigation Branch (SIIB) in the appraising customs formations. While Customs (P) Commissionerates are entrusted with the responsibility of keeping vigil over international boundaries in their respective jurisdictions, the DRI, being the premier intelligence agency for anti-smuggling operations, keeps liaison with foreign countries, Indian missions and enforcement agencies abroad in such matters, in addition to intelligence collection and investigation of cases. DRI also liaises with INTERPOL through the CBI and it is the nodal agency for the CBEC to obtain any information from foreign customs administrations in matters of investigation. To collect intelligence, DRI relies on traditional human intelligence resources as well as contemporary technical intelligence gathering tools. Areas of major concern on the outright smuggling front are the attempted smuggling of gold, narcotics, fake Indian currency notes (FICN), red sanders and ozone depleting substances (ODS), and on the commercial fraud side, undervaluation, mis-declaration of goods, misuse of exemption notifications, misrepresentation of country of origin of goods and related misuse of exemption under free trade agreements (FTAs) and misuse of various export promotion schemes. Statistics in Tables 8.3 to 8.5 indicate trends in outright smuggling of goods and commercial frauds detected by the DRI and other customs formations during the last three years. Table 8.3: Outright smuggling cases detected by DRI and other customs formations (Rs. crore)

Table 8.4 compares the frauds detected by DRI and other customs formations, show-cause notices issued in these cases in FY 2012-13 and 2013-14 and the amount of duty alleged to have been evaded in these cases. Table 8.4: Commercial frauds and duty evasion cases detected by DRI and other customs formations

Table 8.5 gives an account of the actions initiated – number of persons arrested, number of persons detained under COFEPOSA/PITNDPS and number of prosecutions launched. It needs to be noted that the cases mentioned for prosecution launch may not pertain to the FY mentioned, as normally there is some lag between the detection of cases and the launch of prosecution. Table 8.5: Arrests, preventive detentions and prosecutions initiated by DRI

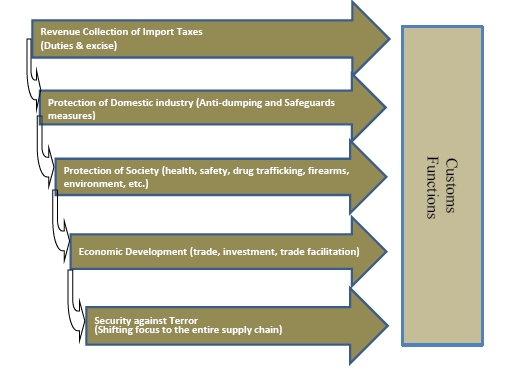

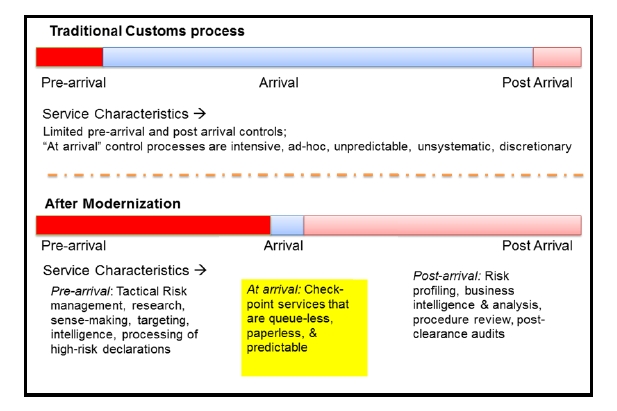

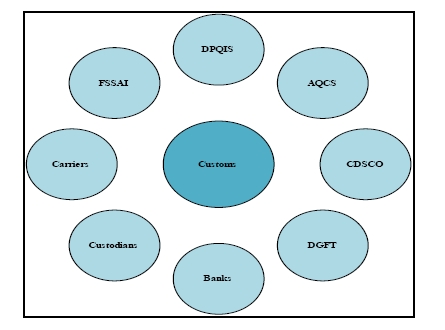

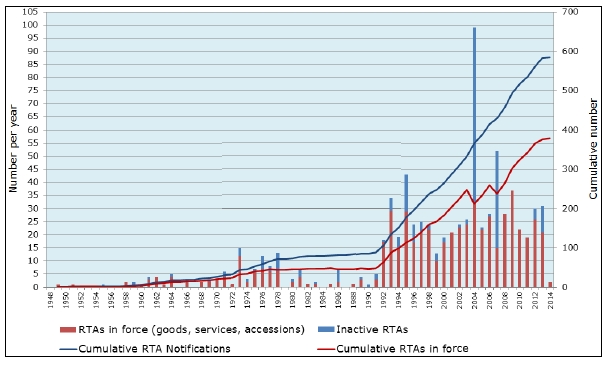

VIII.2.a Procedure for import/export of goods The import/export customs clearance process is handled in an automated environment through the Indian Customs EDI System (ICES), which works in conjunction with the e-Commerce portal of the CBEC, ICEGATE, and the customs' Risk Management System (RMS). The process is described in brief below. i) Clearance at the Gateway Ports/Airports The carrier of goods, i.e., shipping line/airline electronically files an import general manifest (IGM) before arrival in case of imports and an export general manifest (EGM) after departure in case of exports in the ICES either through the service centre or ICEGATE. The importer is required to file electronically a bill of entry (B/E) containing a declaration of goods imported. Similarly, for export of goods, the exporter is required to file a shipping bill (S/B). On filing of B/E or S/B and self-assessment by the importer/exporter, the documents gets transmitted to the Risk Management System (RMS) by ICES. The RMS processes the data through a series of steps and produces an electronic output for the ICES to determine whether a particular B/E or S/B will be taken up for verification of assessment or examination or both by customs or be cleared without any customs intervention after payment of duty, if any. Also wherever required, RMS provides instructions to appraising/examining officers to help them discharge their functions. The accredited clients (ACP clients) are given assured facilitation and their consignments are interdicted for verification of assessment or examination by customs only rarely on a random basis. Post-clearance compliance verification (PCCV) is done to confirm the correctness of the duty assessments. The objective of the PCCV is to monitor, maintain and enhance compliance levels, while reducing the dwell time of cargo. The bills of entry are selected for audit by RMS after clearance of the goods and directed to the audit officers for scrutiny. The number of bills of entry taken up for PCCV may be adjusted locally in the custom house in tune with available manpower resources. Normally, it is kept at 20- 30 per cent of total import consignments. In respect of ACP clients, an onsite post-clearance audit programme has been launched under which the audits are to be done by the central excise/service tax officers in the premises of these importers, along with central excise/service tax audit. ii) Clearance at the ICDs/CFSs – Transhipment of import/export consignments between Gateway Ports/Airports and ICDs/CFSs: Indian customs provide trade with the facility to complete all customs formalities relating to import/export goods at their door steps instead of their having to go to the gateway ports. For this purpose, inland container depots (ICDs) and container freight stations (CFSs) have been opened in the hinterland all across the country. The import/export goods move under bond between gateway ports and ICDs/ CFSs and are transported by agencies like the Container Corporation of India (CONCOR) or other private operators. The IGM filed by the carriers of goods from foreign ports to Indian gateway ports consist of a sub-manifest transhipment permit (SMTP) portion, which is treated as request for transhipment of goods from gateway ports to the designated customs port(s) in the hinterland. The containerised cargo sealed with the shipping agents seal or customs seal (if shipping line seal is found broken or tampered with at the gateway port) are transhipped under a continuity bond along with a bank guarantee submitted by the transporter. The transhipment permit (TP) information is electronically transmitted to the transporter undertaking the transhipment, the custodian of the gateway port and the ICES location at the destination port and it automatically converts into an IGM at the destination port. On the arrival of containers at the destination port, the transporter electronically submits the container arrival report to the ICES, which is then matched with the transhipment message received from the gateway port and a ‘landing certificate' message is generated and transmitted to the gateway port for closure of the IGM lines. Thereafter, the imported cargo is cleared on filing the bills of entry from the ICD/CFS as per the rules. A similar procedure, mutatis mutandis, applies for transhipment of export cargo from ICD/CFS to the gateway ports. The implementation of the Risk Management System (RMS) was one of the significant milestones in the e-Governance initiatives of the CBEC. It allowed the CBEC to move from a regime of virtually 100 per cent assessments and examination to a selective, risk-based approach to assessment and examination of cargo and the ability to release a large number of consignments without much human intervention. The objective was to strike an appropriate balance between trade facilitation and enforcement and optimise the utilisation of human resources. Further, under the Accredited Client Programme (ACP), importers, who have qualified to be accredited clients based on their past compliance record, are granted assured facilitation and except for a small percentage of consignments selected for assessment and/or examination by customs on a random basis by the RMS or cases where specific intelligence is available or where a specific pattern of non-compliance is required to be addressed, no assessment or examination is done.. There are approximately 300 ACP clients registered with the Risk Management Division (RMD) of the Directorate of Systems. Although the implementation of the RMS, together with the accredited clients programme, significantly enhanced facilitation and reduced the dwell time of cargo, these benefits lately seem to have lost momentum owing to certain factors that we deal with later in the report. As the TARC noted in Chapter VII of its first report relating to ICT implementation, while the ICEGATE, ICES and RMS together have made significant contributions in the improvement of the customs processes, the ICT coverage remains partial and does not cover all business processes, many of which remain in a paper environment. Apart from ICT, customs have also taken major steps to modernise by investing in non-intrusive inspection systems such as container scanners. While a system has been developed and deployed in the Nhava Sheva port for risk-based selection of containers for scanning, it is yet to be integrated with the ICES, leading to the two operating in separate silos. A more detailed discussion on this follows later in this report. VIII.3 Emerging trends in the global economy and the changing role of customs The World Customs Organization (WCO), in its Customs Environment Scan 2013, presents the following picture of the emerging global trends in international trade. The world has become ever more interconnected and interdependent through expanded crossborder flows of goods, services, people, transport, capital, information and technology. Globalisation makes it easier to conduct international business than in the past, and provides economies with the opportunity to fast-track development goals through increased international trade. World merchandise trade has grown faster than growth in global GDP. This trend is likely to continue and global trade growth is projected to increase at 4.5 per cent in 2014 while global GDP growth is estimated at 2.6 per cent. While China, the United States and the European Union (considered as single entity) are the largest players in international merchandise trade, developing economies and the Commonwealth of Independent States (CIS) have collectively increased their share and, in 2012, they accounted for nearly half of world merchandise trade. In 2012, more than 80 per cent of world merchandise trade was carried by sea as measured in weight with a growth rate of 4.3 per cent. Containerised trade accounted for 16 per cent of global seaborne cargo by weight, and more than half by value. The air transport industry carried only 43 million tonnes in 2011 as compared to 8.7 billion tonnes carried by the marine transport industry, but it accounted for 35 per cent of the global trade in value terms. Despite a slight contraction in air cargo traffic, the express cargo segment showed a growth of 24.8 per cent and 10.2 per cent (as measured in RTK 105) in 2010 and 2011 respectively. The international express sector is expected to register an annual growth of over 5 per cent consistently through to 2031. It may be added that the growth of e-commerce has a strong correlation with the growth of express cargo as this, together with the postal channel, is the primary mode for delivery of goods, bought over the internet, to consumers overseas. International trade has also become more regionalised. The 2012 trade statistics indicate that 50.7 per cent of world exports were to countries in the same region. Thus, multilateralism seems to be losing ground and giving way to regional trade agreements. Intra-regional trade remained high in Europe (68.6 per cent), Asia (53.4 per cent) and North America (48.6 per cent), but low in South and Central America (26.9 per cent), the CIS (18.5 per cent), Africa (12.7 per cent) and the Middle East (8.6 per cent). Regional Trade Agreements (RTAs) have proliferated over the last two decades. According to the WTO RTA database, 251 RTAs concerning merchandise trade existed as of December 2013, of which 144 RTAs entered into force in and after 2003. Among the RTAs, free trade agreements (FTAs) are most common, accounting for 87.6 per cent of the total RTAs in force. Given that a number of FTA negotiations are currently underway, including "mega-FTAs", in particular the Transatlantic Trade and Investment Partnership (TTIP) between the EU and the United States and the Trans-Pacific Partnership (TPP) between the US, Canada, and 10 countries in the Asia-Pacific region, it appears that the trend in favour of FTAs will continue for the time being. With the increasing dominance of large multinational firms that operate as global networks across national borders, intra-firm trade and trade between related parties has witnessed a steady increase. According to an OECD estimate in 2011, such trade accounted for one-third of world merchandise trade. New technologies, outsourcing, integration of global financial markets and advancements in transport and logistics has transformed the international supply chain. Trends such as the fragmentation of production across national boundaries pose complex challenges in relation to issues of origin and international trade statistics. There has been a steady growth in export processing zones. In 2006, it was estimated that there were 3,500 export processing zones (EPZs) in 130 countries, employing around 66 million people. EPZs accounted for more than 20 per cent of total exports from developing economies, although this varies from country to country. The increase in illicit drug trafficking is an issue of great concern to the international community. Illicit drugs pose a grave threat to public health and safety and the trafficking in such drugs undermines economic development and international stability. The UNODC (2013) indicated that maritime seizures for drug trafficking amounted to 11 per cent of all cases, but each maritime seizure was on average almost 30 times larger than seized consignments trafficked by air. As a result, the share of maritime seizures jumped to 41 per cent in quantity terms. It is estimated that customs is responsible for more than half of all drug seizures worldwide. The issue of security of global trade and international supply chains has attracted considerable attention in the international community in the light of the increasing threat of international terrorism after the 9/11 attacks in 2001. The acquisition of weapons of mass destruction or the strategic goods used to develop or deliver them threatens both national and international security, and a major proliferation event could have a catastrophic impact on global supply chains. Faced with this concern, the WCO introduced the Strategic Trade Control Enforcement Programme (STCE) in 2013 to better assist members to identify and seize strategic goods which could pose a serious threat to global supply chains and to international security. Cross-border movement of dangerous goods that undermine public health and safety is a global problem. The dangers posed by certain counterfeited or substandard goods like medicine, tobacco products and batteries to the health and safety of citizens have been well recognised. The importation and exportation of environmentally-sensitive goods like CFC gases and hazardous waste, etc., has become an issue of increasing concern for customs administrations. Cross border movement of such environmentally-sensitive goods is subject to a variety of multilateral environmental agreements and the role of customs with respect to such goods is to ensure compliance with the trade-related provisions of these multilateral agreements. The emergence of e-commerce is creating a global, virtual and borderless marketplace. This has a direct correlation with the growth in express cargo and postal channels and presents a challenge to the global customs community of handling growing volumes of expedited clearances while maintaining sufficient control to prevent the abuse of this channel. For example, the WCO Illicit Trade Report indicated an emerging trend in seizure cases, namely, an increase in IPR-infringing goods transported in small consignments handled by express companies and by post. Customs import duties remain a significant source of government tax revenue in many developing countries although their share has declined as tariff rates have dropped through multilateral, regional, bilateral and unilateral initiatives. A WCO survey indicated that tax evasion was the first enforcement target for nearly 70 per cent of customs administrations. A WCO report estimated that customs collected more than 10 per cent of total government tax revenue in at least 90 per cent of the countries, more than 20 per cent in at least 74 per cent of the countries, and more than 50 per cent in at least 18 per cent of the countries (in India, as noted above, customs duties represent 15-17 per cent of total central tax revenues). Revenue loss, caused by under-invoicing, smuggling, origin fraud, misclassification, transfer pricing, etc., significantly undermines national economic development and competitiveness. Globalisation also has implications for how customs define "border" in the context of customs control. Increased emphasis on supply chain security, the need to regulate economic activities in the continental shelf and exclusive economic zone, etc., means that it stretches overseas for some purposes, while greater emphasis on post-clearance controls and emergence of SEZs, inland ports, etc., means that it extends to the hinterland. Similarly, "security" in the customs context would go beyond the aspects of physical security and embrace wider issues of the economic security of a country, protection against health and safety hazards, etc. In framing its recommendations, the TARC has kept these dimensions in view. VIII.3.a Emerging role of customs and changing customs control paradigm The trends delineated above pose complex challenges to a customs administration and necessitate a fundamental re-examination of its role, strategies and organisational structures and processes. Effective exploitation of the rapidly developing ICT and other technologies, on the other hand, offer new capabilities for overcoming these challenges. Diagram 8.1 depicts how the role of customs has evolved over time. Diagram 8.1: Evolution of role of customs

In the face of the growing complexity of the challenges before them and the greater need to facilitate legitimate trade, customs administrations globally are getting "smarter". They are investing heavily in technology, simplifying processes and recognising information as the primary lever of control. They have moved away from the "gatekeeper" approach and the control mechanisms they employ are no longer built around the traditional means of checking individual transactions and routine physical examinations – measures that introduce high costs and unpredictability in the cargo clearance process. They rely on advanced risk analysis to intervene by exception at the pre-clearance stage and effective post clearance audits as the chosen control mechanisms. They also place strong emphasis to customer focus – building partnerships with industry, facilitating compliant traders, simplifying procedures and educating industry and the community on compliance requirements through easy to use and exhaustive documentation and other communication channels. With emphasis shifting from static border control to supply chain security, most customs administrations are building strong capacities to effectively implement programmes like the WCO's SAFE Framework of Standards to Secure and Facilitate Global Trade (SAFE Framework), including Authorised Economic Operator (AEO) programmes and mutual recognition programmes. This represents a more evolved approach to compliance management, which seeks to address risks by forging partnerships with willing and compliant traders who maintain prescribed standards of compliance and work with customs to get their records and processes validated. For effective control, the best practising administrations have adopted sound risk management frameworks that focus on compliance improvement by using a mix of appropriate customer service and enforcement interventions. Their HR policies tend to focus on competency building and specialisation among staff and leadership in key areas. The risk assessment is also shifting from being rooted in historic records to a more dynamic, selfevaluating, predictive and continuously improving system. There is also growing realisation that the risk management philosophy needs to be a whole-of-government approach to border management with all other government agencies (OGAs) embracing the global trade facilitation agenda. It is increasingly recognised that the key to effective tax administration is a system that encourages and incentivises a culture of voluntary compliance by the taxpayer. Hence there is a pronounced emphasis on good governance, accountability and transparency. The functioning is within the framework of clearly articulated strategic plans and performance goals. An increasing number of administrations also regularly publish data on their performance and regularly obtain customer feedback. In short, to cope with diverse emerging challenges faced by them, customs administrations have moved from the traditional administrative approach to a more strategically oriented and wholesome compliance management approach aimed at maximising voluntary compliance and founded on robust and reliable risk management. In terms of the core customs clearance process, their approach broadly has been to delink issues relating to duties, tax, etc., from the clearance decision, which revolves primarily around what are called "admissibility" issues (security, health and safety, contraband etc.), which risks necessarily involve pre-clearance treatment. Duty or tax related issues are usually handled in a post-clearance environment. Further, compliant traders are also allowed duty payment on a periodic basis, based on a return that they are required to file. Thus, in such cases, release of goods has been delinked from duty payment and globally, the customs assessment and duty payment process has moved much closer to the one already widely in vogue everywhere, including in India, in relation to assessment and payment of taxes. Table 8.6 gives a broad comparison between the Indian situation and global trends in customs administrations. Table 8.6: Comparison in Indian customs administrations with global trends

The impression of there being a large gap between the current state of customs administration in India and international best practices is reinforced by some of the key feedbacks the TARC got from consultation with various stakeholders, which is summed up below:

Customs are also not regarded as being responsive to emerging needs and opportunities for industrial growth. For example, although the country has the potential to be a choice destination for exhibitions, seminars or other international events, its realisation is inhibited by the discretionary nature of controls on temporary imports and inconsistent practices. India is widely considered as a temporary import unfriendly country. Some of the notifications issued in this regard have been written in 1994 and 1995 and do not seem to have been reviewed to suit contemporary needs. VIII.4 Way forward VIII.4.a Governance The starting point for capacity building in the CBEC must thus begin with an assessment of the "as is" situation and the development of a clearly articulated vision and strategic plan that is aimed at rejigging its governance and placing it among the "best in class" customs administrations. The plan should set out clearly the strategic goals of the CBEC and the implementation strategy to achieve them. It should also focus on putting in place appropriate service standards and performance standards that are measurable so that progress can be reviewed on an ongoing basis. And the implementation needs to be backed by a robust performance management framework using which the CBEC can continuously track and improve its performance and benchmark itself regularly with best international practice in the spirit of continuous improvement. This will require a strategic reorientation of customs, shedding the overwhelmingly transactional and administrative mind-set that dominates thinking. The strategy must be centred on measures calculated to promote voluntary compliance and leverage technological capabilities to enhance its ability to control the cross border movement of goods and persons with as little intrusion as possible. It will need the customs to get far more customer focused and forge much closer links with trade and industry in designing and implementing policies. It will need to undertake a much more intensive stakeholder engagement to promote voluntary compliance and move in the direction of a partnership-based, collaborative approach towards good corporate citizens who have the capacity and commitment to share responsibility for compliance. In Chapter III of its first report, the TARC had set out the key principles and values that should form the foundation of the structures and processes of governance and recommended a functional restructuring of the organisation to suit contemporary and emerging requirements. These will have to form the fulcrum of the customs' strategy. The strategy should reflect the changing role of customs, looking beyond exclusive revenue orientation, and focus on capacity building in emerging areas such as the AEO programme and SAFE frameworks, RTA administration, and proper application of trade remedies, non-tariff barriers, environmental and safety issues, border functions relating to Intellectual property rights etc., which are dealt with in this report. The strategy should also recognise the vital importance of facilitating legitimate trade in enhancing the international competitiveness of the country. As noted earlier, the forces of globalisation have transformed manufacturing and led to increased movement of intermediate goods across national borders. Increasingly, a manufactured item will involve raw materials and components that have moved back and forth among multiple countries before emerging as a final product in one jurisdiction. Supply chain economics have become a key factor in today's manufacturing and trading environment, with emphasis on lowering costs and managing just-in-time inventories and any undue break in the supply chain can have serious consequences on the viability of a business. Unpredictability and delays in border procedures therefore directly affect the investment climate of a country and far greater understanding of the consequences of their actions and a much greater sense of responsibility in the exercise of authority needs to be exhibited by customs officers at all levels. It, therefore, should aim at developing systems, structures and processes that ensure that the response of the CBEC is consistent and uniform across the spread of the organisation, whether it is in the area of customer services or enforcement. Again, as noted in Chapter VII of the TARC's first report, ICT needs to be far more deeply embedded in the governance structures and processes in order to reflect the realities of the digital world. A cornerstone of the customs strategy, therefore, will have to be an ambitious plan to become a fully digital enterprise. The importance of this cannot be overemphasised as ICT is the key enabler for the organizational transformation that is needed. The TARC had, in Section VII.6 of that chapter, suggested a roadmap for the journey towards the "digital by default" status. Thus, there must be a clear articulation of the customs vision that focuses on the following.

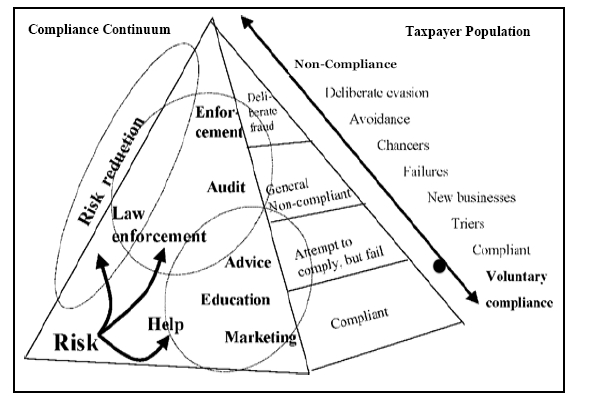

This entails changes in its control paradigm, which must shift from a transaction based approach characterised by high levels of pre-clearance interdiction to intelligence-led, risk based interventions by exception, with supply chain management and post-clearance audits as the primary tool for compliance management. Unless this happens, CBEC cannot hope to achieve comparability with the global best practices in customs administration. There is no choice but to do this as it will be well-nigh impossible for it to fulfil its mission with the traditional methods of routine transaction-based processing of import and export documents in the face of growing workload. It must take bold decisions to move away from the traditional approach if customs are to transform themselves into facilitators, rather than inhibitors, of the country's economic growth. With the implementation of the risk management system (which included the introduction of postclearance audit), the introduction of the accredited clients programme and the legal changes in the Customs Act, 1962, in 2011 to introduce the principle of self-assessment, Indian customs have taken the first necessary steps towards modernisation. The launch of the AEO programme was the next step in this direction. The CBEC also clearly acknowledged the crucial importance of facilitation in its operations when it, vide circular F.N. 450/20/2007 – Cus IV dated Sept. 2, 2011, laid down, for the first time, facilitation targets. While the implementation of RMS has enabled it to resort to targeted selection of consignments, enhancing the level of facilitation of legitimate trade while subjecting riskier transactions to closer scrutiny, customs in India have not developed an enterprise risk management framework in the context of which tools like the RMS need to be operated. The TARC has noted the absence of such a framework in Chapter III of its first report and recommended the creation of a functional vertical for strategic planning and risk management. As the TARC had noted in the first report, the usual tendency in organisations, including the CBEC, is to focus only on operational risks, resulting in inadequate preparedness to cope with challenges that threaten their mandate. That recommendation is reiterated in the present context too. The various interactions that the TARC had with stakeholders, including departmental officers, gave it the unambiguous impression that the spirit of the compliance philosophy that underlies the principle of self-assessment has clearly not been internalised in the department, particularly at the operational level. The TARC believes this to be partly due to weak and inconsistent articulation of the strategic and operational goals and poor communication across the organisation. It is also due to a pervasive transactional mentality even in the leadership. Radical improvements are needed on both aspects. As the TARC noted in its first report, self-assessment marks a fundamental change in the relationship between the government and the citizen (or the taxpayer). It is founded on voluntary compliance and on trust as the first principle of administration, and a shared responsibility for compliance. In essence, the administration, while devolving the responsibility for compliance with laws to the affected citizen or business, assumes responsibility for creating conditions in which the taxpayer is enabled to fulfil his responsibility. This responsibility does not seem to be adequately owned at any level in the organisation. For instance, the TARC heard repeatedly during its interactions with stakeholders that there is a marked reluctance on the part of field officers and the CBEC to clarify contentious or doubtful issues when clarification is sought, leading to uncertainty and divergent practices and feeding into avoidable disputes, which add to costs for traders. In Chapter V of the TARC's first report, it has cited international best practices and highlighted the need for the CBEC to proactively step in and issue clarificatory circulars using the provisions of Section 151A of the Customs Act. The implementation of this recommendation will go a long way in meeting a frequently expressed need by importers/exporters. It is equally necessary to undertake periodic review of every circular, notification etc. to examine its relevance and contemporaneity in the context of changing environment. The use of sunset clauses is a valuable way to ensure such reviews and should become a regular practice in CBEC. Another recommended practice is to consolidate the instructions/circulars etc. periodically and publish comprehensive compendia subject-wise, superseding the previous versions. This will ensure clear and user friendly guidance to trade as well as officers 106. With the introduction of self-assessment there is also a need for CBEC to develop and make available detailed guidance in the form of self-assessment check lists in important areas which can assist the importers/exporters in achieving compliance. In order to enhance the certainty for the taxpayer, the provision of advance ruling is an important tax payer service. In view of its current weaknesses, in Chapter V of its first report, the TARC had given recommendation for revamping the advance ruling mechanism. This is relevant in the customs context also because provision of advance rulings is an important requirement under the Revised Kyoto Convention. Another key input the TARC heard was the lack of user friendly access to updated notifications, rules, regulations, etc., on the official website. In Chapter VII of the first report, the TARC had recommended adoption of a maturity framework for continuous enrichment and improvement of the CBEC website, by improving navigability, searchability and ever improving user friendly features, and adoption of "what is not on the website does not exist" policy, which will meet this long-felt need. This means conscious adoption of a policy that no law, notification, circular can take effect unless it is first published on the official website. It also entails a sound content management process for constant updating that ensures that everyone, whether a customs officer or a trader, can fully rely on the information on the official web-site. And this with a degree of robustness that eliminates the need of the "disclaimer" that typically occurs on such websites. The website should be the official face of the department without any caveats. Measures like this will go a long way in promoting voluntary compliance and contribute to transparency, predictability and certainty in the application of laws and procedures. The CBEC needs to adopt such modern best practices and put resources behind these programmes. One of the key factors that inhibit the full implementation of some of the initiatives is the general absence of a programme management approach. In Chapter VII of its first report, the TARC had identified this as a critical deficiency in the context of ICT implementation. This point is equally valid in relation to the other areas of importance such as the AEO programme and post-clearance audit programme. For successful implementation of such key initiatives, the CBEC needs to adopt such an approach. This will necessitate a well-defined process and methodology that places the particular programme in the overall strategic plan of the CBEC, clear articulation of objectives and goals, a clear programme and process ownership and allocation of roles and responsibilities, planning and deployment of resources, and a rigorous performance measurement and evaluation to assess the outcomes, so that further improvements can be made. Such evaluations are indeed a prominent missing link in the programmes implemented so far. The ACP was launched as a flagship facilitation programme of the CBEC in 2004. However, there has so far been no systematic evaluation of the programme to assess its impact and to effect improvements. The same is true of the post-clearance audit programme. The CBEC also needs to develop a robust risk management framework that dynamically addresses all dimensions of risk and enables it to build the required capacities to face emerging challenges effectively and efficiently. VIII.4.b Upgrading the risk management in customs Diagram 8.2 is an illustration of a dynamic risk management framework. Diagram 8.2: Dynamic Risk Management Framework

Source: Risk Management Guide for Tax Administrations, Fiscalis Risk Analysis Group, European Commission As can be seen, differentiated strategies and interventions need to be adopted in relation to different segments of clients whose behaviours range from voluntary compliance to deliberate noncompliance, in order to promote compliance and reduce risk. At one end of the spectrum are clients who are highly compliant in that they exhibit both the capacity and commitment to compliance. The approach towards them has to be highly facilitative and partnership oriented, with the full range of facilitation benefits extended. At the other end are those that exhibit extreme disregard for law. The approach towards them has to be enforcement oriented with frequent checks and application of strong sanctions to deter non-compliance. In between is a wide range of clients who exhibit varying degrees of compliance, towards whom the approach has to be calibrated according to their behaviours and motivations and key factors in their environment that affect their attitudes towards compliance. It has necessarily to be an appropriate application of enforcement and audit interventions combined with encouragement through help and guidance, in the case of those who are not inclined towards non-compliance but lack the capacity in terms of knowledge or resources to achieve full compliance. The goal of strategic risk management is to progressively and consistently move the client population towards the compliant end of the spectrum, thereby improving the overall compliance environment. Critical to the success of such a framework is robust and effective segmentation of taxpayers. This needs to be analysis and evidence based and not merely opinion or perception based. It can only be achieved through extensive research and analysis, with multidisciplinary skills such as those of data analytics, social scientists, customer service specialists and domain experts being brought to bear on the task. And such research needs to be seen as a continuously evolving process, rather than as a one-off project. The key point to be borne in mind is that risk management is not just about having good processes. It is a way of thinking that moves a customs administration toward proactive – rather than reactive – approach. Risk management in customs, including intelligence and operations, must rest on an effective regulatory framework, which should be aimed at encouraging voluntary compliance. Although the basic thinking underpinning risk management may remain the same, its cyclical nature allows constant improvement. This may mean reconfiguring estimated risk levels, introducing new technologies, creating new capacities or sharing more risk with other supply chain participants. Measurement and feedback are a key component of risk management, which should essentially be seen as an iterative process. Key risks need to be identified on the basis of analysis of data and other evidence and treatment plans designed and implemented. This should be followed by an evaluation of the measures taken and this should be fed back into risk management. For example, if non-compliance, say, in the form of erroneous classification of a particular good, is detected across many locations and across different segments of taxpayers, it might reflect a commonly shared interpretation of the relevant entry rather than a deliberate attempt at evasion. In such a case, the appropriate treatment of the risk would appear to be a clarification setting out what the department regards as the correct interpretation. In other situations, responses could be different depending upon the nature and gravity of risks, their impact and the perceived motivation of the concerned parties and could lead to enforcement actions. In still other situations, the risks could be addressed through public education and outreach programmes, investment in technology and development of the relevant competencies and so forth. In important areas, compliance improvement plans need to be developed, communicated effectively and implemented, and their results measured and evaluated and the process continued in a cyclical fashion. The creation of the functional vertical in the form of Strategic Planning and Risk Management (SPRM) Directorate, as recommended by the TARC in Chapter III of the first report, will enable the CBEC to impart a strategic dimension to its efforts by anticipating major challenges, and responding ahead of time so that threats to compliance are effectively mitigated. An important function of this vertical should be to continuously scan the environment for emerging trends in terms of business practices, technologies, etc., and prepare the organisation by planning the required human, organisational and technological capacities to either cope with the threats to its mandate or to exploit the potential emerging trends may offer. The CBEC will also have to build a far greater capacity for use of data analytics for more effective risk management. In Chapters III and VII of the first report, the TARC had highlighted the crucial role that data analytics plays in better policy making and effective risk management, and recommended the setting up of a Knowledge and Analysis Centre (KAIC), comprising a range of data and analytical skills to support strategy, policy making and operations. Apart from this, the TARC had also emphasised that a high degree of analytical ability will have to reside in the functional verticals as well. VIII.4.c Closer strategic involvement in development of trade policies Greater emphasis on analysis will enable the CBEC to play a meaningful and constructive role in the government's trade policies as well. For instance, there is an urgent need for a cost benefit analysis of all FTA's to be done; this has not happened .While we do know the steep increase in imports from our FTA partners simply because of the huge market access we are offering, little fact based analysis is done about the exports from our country to these FTA partners. With more such pacts on the anvil, such as the Regional Comprehensive Economic Partnership (RCEP) involving the 10 ASEAN Member States and ASEAN's free trade agreement (FTA) partners viz. Australia, China, India, Japan, Korea and New Zealand, such research is of critical importance. It is in view of the growing importance of this area that later in this chapter we have recommended the setting of the Directorate of Origin that will devote focused attention to this area. Similarly, even though the SEZ scheme does not come under the purview of Customs directly, there is an urgent need for cost benefit analysis. While customs have some idea about the customs duty foregone there is an absence of reliable and comprehensive data about the excise duty and service tax that are not collected. There has been no empirical study done of the benefits which the country has had because of the SEZ scheme while there have been instances of clandestine diversions into DTA or mis-invoicing of goods. By basing their arguments on research and evidence, customs can contribute to shaping of the country's trade policy with greater persuasiveness and credibility. At present they are perceived as excessively revenue driven and ignoring the wider interests beyond revenue. Often they may have a valid argument; however, because it is not backed by adequate analysis and evidence they are not able to argue persuasively. VIII.4.d Strengthening of Risk Management Division In the specific customs context, it is the Risk Management Division (RMD) that will have to take a key role in this respect. It needs to be substantially revamped and strengthened to enable it to assume a more active strategic as well as operational role in customs risk management and to achieve greater integration of customs processing with intelligence driven risk management. At the strategic level, its research output should support the CBEC in developing programmes and policies as outlined earlier. At the operational level, it needs to build the technological and human capacity to use advanced analytical tools to engage in predictive analysis and improve risk assessment to sufficient levels of accuracy to allow virtually all legitimate traders to continue their business without intervention, and to allow for the remainder to be targeted. It should also be enabled to develop new algorithms and invest in sophisticated search and match technologies that will improve its ability to identify both individuals and cargo for interdiction. As has been mentioned above, feedback and re-evaluation is a critical component of the risk management process. This does not seem to be happening adequately. The RMD needs to undertake constant evaluation of the performance of the RMS to ensure that there is sharpening of the risk rules, targets or interventions inserted by the national and local risk managers to improve the quality of matches with suspect profiles. This will ensure that a large number of consignments are not unnecessarily checked, thereby adding to delays in clearance and associated costs on the one hand and waste of customs resources on the other. Under the current system, the local risk managers at the custom houses have the ability to insert targets and interventions for their respective locations. Experience has been that these tools have been used without adequate care and competence, leading to a large number of consignments getting unnecessarily assessed and examined by officers. To check this, RMD needs to be empowered to assume a greater national role and exercise greater control over local risk managers by issuing appropriate directions to ensure that the quality of performance is maintained and it is consistent across the country. Ideally, the local risk managers should step in only when there is a particular risk specific to their location or where they have reliable local intelligence as many of the key risks are national in character. It should be the RMD that primarily controls the system in order that a national consistency is maintained and interventions are purposeful, based on proper analysis and evaluation. With the installation of the first container scanners in Nhava Sheva port, a risk management module for risk based selection of containers for screening was implemented. It was a standalone module, which was not integrated with the ICES, with the result that the officers processing the consignments in ICES do not have access to the images of screening. Now that these scanners are being installed in different ports, container selection should be put on a much more robust footing. It should be integrated with the risk management system and the ICES. The CBEC should progressively move away from a purely local approach towards a national approach that will ensure that risk management techniques are applied consistently across the country. It should move towards setting up a national targeting facility in the RMD along the lines many customs administrations, such as those in the US, Australia and New Zealand, have set up. The facility should be linked to all the ports and take in scanning feed from them. The decision on whether to clear a container or examine it should be taken by specially trained staff and communicated to the customs in the port. In course of time, the facility should also house the representative of other border agencies as a co-ordinated risk management framework is evolved by customs so that coordinated decisions can be taken. VIII.4.e Revamping the core customs clearance process The customs clearance process in India continues to be in the traditional mould even after the introduction of the self-assessment and risk management system. There are a large number of consignments that are assessed and examined on arrival, leading to goods taking a relatively longer time for clearance than in many other countries. Data provided by some stakeholders indicates that the time taken for customs clearance in Australia, Germany, Netherlands and Singapore ranges between 1 to 3 hours where cargo is not selected for inspection and 24 to 72 hours where it is selected for inspection. There is far greater reliance on advance submissions of cargo and goods declarations and a much smaller percentage is selected for examination at ports. The processes in advanced countries are more or less in the following order:

Diagram 8.3 depicts the pre and post-modernisation customs control paradigm. Diagram 8.3: Pre and post-modernisation customs control paradigm

To make sure that the ‘at arrival' is generally paper-free, the following must happen:

The physical process of cargo delivery for import, export and transit in modern customs administrations must be as orderly and predictable as that of a passenger checking in at an airport to board a flight. The CBEC should aim at aligning its operations with this process and minimise pre-clearance intervention so that cargo moves seamlessly through Indian ports and airports. They should also aim to follow the international norm of separating duty payment from release. They can introduce this in a calibrated manner, starting with trusted partners such as AEOs. For the rest, they must progressively reduce pre-clearance checks, finally limiting them only to very high risk importers such as fly-by-night operators who are difficult to trace once the goods are cleared. This would imply a change in the control paradigm of the CBEC to align it with international best practices. As in developed administrations, cargo will need to be stopped primarily to address risks that bear on admissibility issues, such as security, hazardous goods, etc., of the type that require that the cargo needs to be stopped at the border. Ordinarily, there should be no stoppage of cargo for duty related issues that can be handled in a post-clearance environment. The cargo examinations should be targeted, designed primarily to confirm the declarations and with a much more thorough examination of selected cases which should form a much smaller percentage of total consignments (unlike the current situation where a large number of consignments get selected for examination but are subjected to 5 to 10 per cent examination). The facility for examination at the importer's warehouse should also be extended on a selective basis where the movement of cargo is adequately secured through means such as track and trace technologies. This will decongest ports and airports and enhance their cargo throughput, thus saving wastage of substantial resources. But for this to happen there is need for tremendous investment into pre-arrival risk assessment and post-clearance compliance management. This necessitates that the CBEC puts in place a regime in which advance filing is the norm and ensures that the data quality of the declarations is of the requisite standards. TARC's consultations with stakeholders indicate that even though the legislative framework exists, error free advance filing is far from being a reality, leading to the necessity of amendments which are time consuming and which delay the process of clearance of goods from customs. One factor that was mentioned to the TARC was that in India the responsibility for filing import general manifest in advance was divided between the carrier and agents and the latter were allowed to file house level details, whereas internationally it was the carrier who bore the responsibility squarely. Without going into the specifics of the issue, which the CBEC is best placed to judge, TARC would only wish to emphasise that error free advance filing is a critical requirement for the success of pre-arrival risk assessment that will enable smooth passage of compliant cargo through the Indian port and airports. Hence, the CBEC needs to adopt measures that will ensure the creation of such an environment. It needs no elaboration that a major focus of customs checks is revenue and there is a perception that relaxation of these checks would lead to loss of revenue. It is often argued that the compliance environment in India is very different from the advanced economies where such measured are adopted. It appears to be a misconception that advanced nations can afford these processes because revenue is not a concern. As noted earlier, 70 per cent of the customs administrations surveyed by the WCO listed duty evasion as their key priority. As far as Europe is concerned, nothing is further from the truth. With VAT at 21 per cent, the risk of loss of revenue is often very high in some EU countries and this is managed through a very strong system of controls that are not applied only when goods arrive (as in traditional customs administrations) but across the entire breadth of the supply chain process. There is direct communication between customs and tax authorities and multiple syncs of transaction data. Besides, customs administrations of Western Europe have very sophisticated revenue accounting systems with very well developed internal controls. These systems take into account advance payments, deferred payments, transactional payments and guarantees of different types that may apply to different classes of clients or transactions. These systems provide for strong revenue oriented controls and that is the direction in which India must progress. The argument that the compliance environment in India is unsuitable for processes similar to advanced economies also begs the question whether the current methods of control are able to effectively counter non-compliance in the form of under invoicing or over invoicing. Any objective analysis will return a negative answer. First, the general experience is that the extra revenue generated through enhancement of assessable values is marginal to the total revenue collection and generally does not exceed about one per cent of the total revenue. Secondly, this extra revenue does not necessarily represent the correct amount due. This is because importers often agree to pay the extra duty if the cost of delay in clearance due to demurrage etc. or the urgency of their requirement exceeds the additional duty demanded by customs, and not because the demand is legally sustainable. Thirdly, the poor success rates in appeals where importers choose to contest such assessments reflect poorly on the quality of customs orders in such cases. And lastly, such cases usually do not comprise more than 10 per cent of the total transactions scrutinised by officers. In substance, this would imply that a large number of transactions that are directed by the RMS to officers did not actually require their attention. To that extent there is wastage of resources for customs as well as importers, who suffer cost due to delays and unpredictability in clearance. While this underlines the need for sharper edge to risk management system, as mentioned in the previous section, it also highlights the necessity for customs to revisit rationale of the entire process. It is equally important to bear in mind the fact that the current process, which is a gatekeeper type operation, gives rise to frequent opportunities for rent seeking behaviour on the part of errant officials creating a serious moral hazard for the organization. If proper analysis is done, it will show that the opportunity cost of using the bulk of resources in routine administrative tasks, when there are more important demands on resources, far outweighs the possible revenue loss. If the compliance environment is perceived to be very adverse, the leaders of the customs administration need to ask themselves what they are doing about it. Quite apart from the fact that such perceptions are not based on any studies on compliance measurement, they can exert a positive influence on the compliance environment by improved governance and accountability, strategic interventions such as improved customer services, greater consistency, clarity and transparency in approach, and better targeted enforcement. The other area of the core process that is acquiring greater importance is the clearance of express consignments. As has been mentioned earlier, the growth of e-commerce has led to increasing use of express cargo as also postal channels that deliver consignments directly to the customers. The CBEC had undertaken a project in a PPP mode with the Express Industry Council of India to automate this process. It is learnt that it has not been fully implemented yet. It is necessary that the implementation is completed at the earliest as the volumes in this category are bound to increase. There is an equal necessity to automate the postal clearance process. Globally, express clearance is now being seen as a sub-set of the customs clearance process. The automation of this should therefore also ensure that these different modes are brought within a common risk management framework. This will enable customs to meet genuine needs of industry as well. Currently, the knowledge about different industry sectors, groups of commodities, etc., is acquired by appraising officers only in the course of their working. While some are good at picking it up, many others are quite indifferent. The practice of recruiting expert appraisers that was in vogue a couple of decades ago has been discontinued and later, even the direct recruitment of appraisers has been discontinued. This has resulted in drastic fall in the levels of knowledge and ability. Posited against the growing volumes and complexity of imports and exports, and the continuing expansion of ports, inland container depots, etc., the shortage of knowledge and skills leads to increasing thinning of its resources; this is a major challenge before the CBEC. It, therefore, needs a strategic response. The TARC believes that the response should be for the CBEC to move towards the centres of excellence concept and use the potential of ICT to cope effectively with the challenge. Even a broad analysis will show that a few groups of commodities contribute a large share of customs revenue. Steps should be taken to ensure that officers develop deep knowledge and expertise in the relevant commodities and the task of compliance verification in relation to the relevant discipline is assigned to such teams, who will assume this responsibility across all customs locations instead of being limited to individual locations. In other words, the CBEC should move to a model of centralised processing for compliance verification. There are different options which could be considered and it does not necessarily mean that a single central facility has to be set up. Even the current ICT infrastructure, wherein all locations are networked, has the potential to enable this with appropriate legal and administrative changes. The commodity groups can be divided among the major custom houses and international air cargo complexes and highly trained teams with the requisite expertise assigned national responsibility for transaction-based compliance verification. The function of physical inspection and examination of cargo that requires the physical presence of officers will continue to be performed at the respective locations and will be driven by clear risk-related instructions. This will lead to the following benefits:

This will entail a number of other steps, such as changes in HR policies for nurturing specialisation, robust knowledge management systems, etc., that had been highlighted in the first report of the TARC. It will also necessitate the creation of a supporting legal and administrative framework. An important requirement will be complete digitization of the entire process of clearance. This will require determined efforts to implement the system fully. The ICT system should be the sole channel of communication between customs and trade. Currently, there are areas where manual interventions are made even where the system has a provision for on line interaction 107. Such deviations will have to be firmly eliminated. This will also need a pronounced thrust on dematerialisation of paper documents and making them available to officers digitally wherever they are needed, coupled with a document management system that will free up a lot of space. Such solutions are widely available and a large number of organisations, in the private and public sectors, including banks and financial institutions, have implemented them. The directorates of systems and logistics will have to jointly work together to implement it on a nationwide basis in the CBEC. The CBEC also needs to undertake periodic reviews of key business processes, in the spirit of continuous improvement, to simplify and streamline them and enhance their efficiency and effectiveness. Some of the difficulties expressed by stakeholders in the TARC's consultations related to the absence of such reviews and the lack of standardisation with different practice in matters such as bonds, bank guarantees etc. being followed in different regions. As recommended in Chapter VI TARC's first report, the CBEC needs to develop standard operating procedures and publish them in manuals covering all key areas. In Chapter III of that report, the TARC has also recommended the setting up of the Directorate of Business Excellence for continuous improvement. If the primary mode of customs control has to shift from pre-clearance interdiction to postclearance audit, substantial capacities need to be built in this area. If the unproductive pre-clearance interventions are minimised, sufficient resources can be generated for audit. Typically, audit takes two forms – desk based scrutiny of identified transactions post-clearance, which happens in the office, and focused scrutiny of accounts and related business records, which happens in the business premises of the traders (described as on-site post-clearance audit, OSPCA). Both need to be risk based and based on sufficient knowledge of business and accounting practices on the part of officers. It is also important to understand the proper role of scrutiny, whether pre- or post-clearance, of a transaction in the self-assessment paradigm. Rather than an act of assessment, it should be perceived as a method of risk treatment conducted either before or after the clearance of goods, depending on the typology and gravity of risk. It needs to be borne in mind that the post-clearance audit is as much an audit of the RMS as it is of the importer's compliance. It is therefore important that its results feed back into the RMS for improving its performance. As far TARC is aware this loop is missing and needs to be put into place. One of the important functions assigned to auditors, when the desk based post-clearance audit programme was implemented, was the check on data quality. The instructions specifically required them to pay attention to this even if there were no other compliance issues and give a feedback to importers for improvements where necessary. The RMS has tools that help officers to monitor whether the importers comply with such advice or not. It is not known whether this is actually being done. In an environment in which information is the key lever of control, the effectiveness of customs control is critically dependent on the quality of the data in the declaration filed in its system and CBEC needs to actively focus on such interventions to ensure that deficiencies in data quality are made good and the data in its systems becomes highly reliable over time. It is reported that there are large pendency of transactions selected for post-clearance audit in custom houses. This needs urgent attention. A major goal of risk management is to match work to available resources. Implicit in this is the principle that all transactions need not and should not be scrutinised. The CBEC also needs to examine both the quantity and quality of the selected for audit having regard to evaluation of risks and limit them to acceptable numbers so that compliance verification happens in a purposeful manner with a clear focus on addressing identified risks. As far as OSPCA is concerned, it is entrusted to central excise officers. Apparently, very few audits have happened as yet. However, the stakeholder feedback indicates that officers sent for audit lack enough knowledge about customs issues. There is need to ensure that the officers are properly trained before they are assigned this task. In the current set up, there is an absence of programme ownership and a very weak link between policy and implementation. In Chapter III of its first report, therefore, the TARC has recommended strengthening the functional vertical for audit and achieving an integral link between policy and delivery and that would be the first step towards capacity building. The ownership of the postclearance audit programme needs to be clearly vested in this vertical. Further, as noted by the TARC in that report, specialised knowledge about key industries needs to be built and sustained within this function. With the shift of emphasis from transactional compliance to supply chain security, skills in the domain of systems audit and certification also need to be nurtured in the organisation. There is also a need for capacity building in handling related party transactions. The significance of this can be gauged from the fact that according to a WTO estimate, they account for over 30 per cent of global international trade, and with the growth of multinational corporations, this will only increase. Currently, this issue is handled by the special valuation branches (SVB) of specified major custom houses. As the TARC noted in section VI.11 of the first report, the process is out of line with global practices and India is the only country that follows the "gatekeeper" approach. The process is far from satisfactory either from the importer's or the department's perspective. There are huge pendency in SVB cases and the quality of decisions also leaves much to be desired. Further, the requirement of the extra duty deposit (EDD) continues to be a major irritant to trade. It is reportedly being routinely increased from 1% to 5% at the slightest delay on the part of importers. On the other hand, customs are reportedly not discontinuing it (as they are required to do under extant instructions) when decisions are not taken within three months of the importers furnishing their responses. Stakeholders have mentioned to the TARC that the refunds of EDD, when cases are finally decided, are also beset with difficulties, as the process is not captured in the EDI system and the original documents are frequently lost in customs. As things stand, the EDD appears to serve little purpose and the CBEC needs to seriously consider dispensing with it. Customs need to accept the principle of self-assessment in letter and spirit, to move to a risk-based approach in this regard and make post-clearance compliance verification the chosen mode of valuation control. The Directorate of Valuation, which is already notified as the nodal agency to control the SVB process, should be strengthened to play a more active role in such audits and should be converted into a centre of excellence in valuation by staffing it adequately and building strong valuation expertise. It is often assumed that the customs services of a country already possess the necessary capacity in this respect, usually because these services have a history or tradition of applying customs tariffs to imported goods. However, it is not a good policy to make assumptions about the capacity of a customs service without taking a good look at the actual state of affairs on the ground. In India, a survey conducted in 2004-05 as part of ARTNeT/RIS study on trade facilitation identified customs valuation as the key problem for the trading community. In addition, it should take responsibility for actively providing detailed guidance to importers through lucid and clear publications that set out detailed guidelines relating to the valuation regime, including documentation requirements (as recommended in Section VI.10 of the first report), so that there is reduction in the opacity of the customs' approach and importers are better prepared to address issues in collaboration with customs. The practice statement No. B_IND 08 dated April 12, 2013 issued by the Australian Customs and Border Protection Service (ACBPS) is a good example of this practice 108. In fact, such user friendly guidance is regularly issued by ACBPS relation to key issues in the area of valuation such as valuation of automobile imports 109, valuation of free of charge goods, 110 etc. This is a practice followed by many customs administrations and CBEC will do well to emulate it. There is also need for greater collaboration with transfer pricing authorities on the direct taxes side so that documentation requirements are harmonised to the extent possible. Importers should also be enabled to make a suo motu declaration even during the validity of the SVB order where the factual matrix underlining the original decisions undergoes a material change. One aspect that seems to have attracted little attention on the part of customs in relation to valuation is the aspect of countering trade based money laundering (TBML). And this is because of the predominantly transactional focus that the current control regime is characterised by. TBML is being increasingly recognised as a major issue internationally and a number of studies show the growing threat to national economies it poses.111 TBML is generally undertaken by misinvoicing of goods imported into or exported from a particular country. Generally, goods are

Such trade mis-invoicing has adverse effects not only from a money laundering perspective, it also helps traders avail of illicit tax incentives and by-pass capital controls. There are a number of indicators that can point to potential TBML risks. These include the following: